Reactive Index lets you buy index tokens on the Sui blockchain, as part of the DeFi ecosystem.

Each index token represents a basket of crypto assets, similar to how an ETF or index fund works in traditional finance, but fully on-chain and self-custodial.

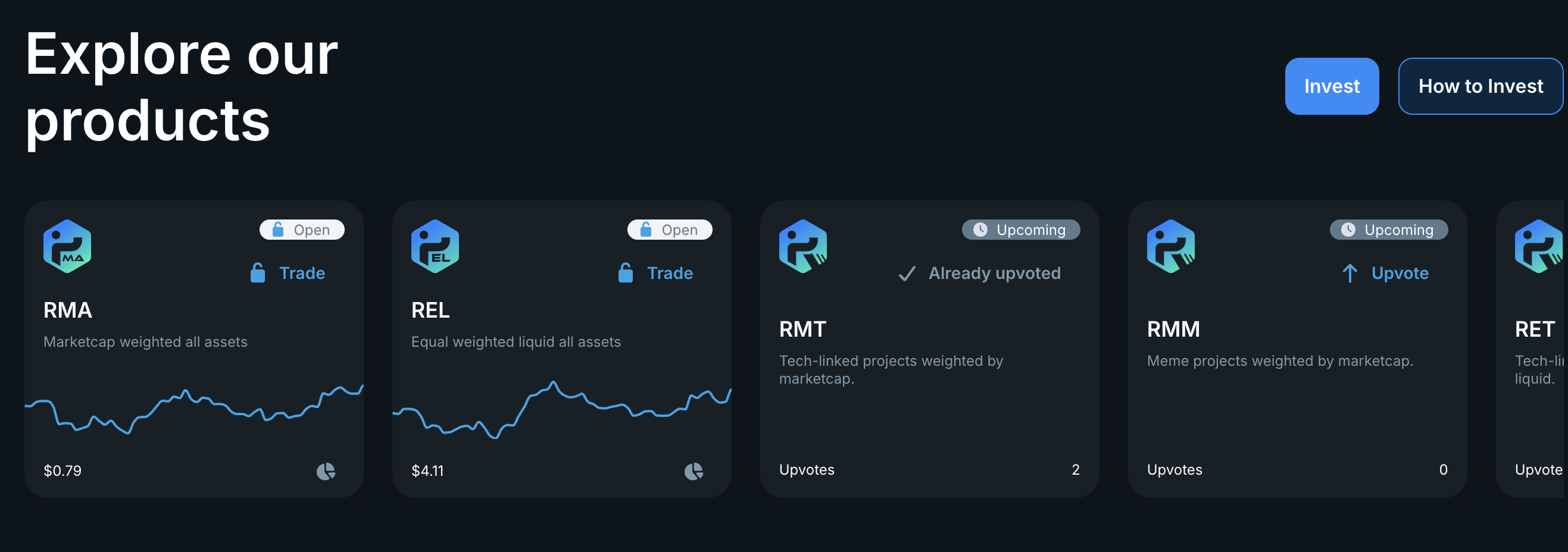

There are two main product families:

- Strategic Indexes

- Liquid Indexes

Everything else (fees, income, mechanics) revolves around these.

What is an index token?

An index is a product that:

- holds a basket of underlying tokens

- mints a single index token that represents a share of that basket

Key properties:

- the index token directly represents on-chain assets

- you always keep self-custody in your wallet

- you can see composition and changes in real time using the UI or on-chain data through an explorer

No liquidity pools: how buying and selling works

Unlike many DeFi products, there is no AMM liquidity pool behind Reactive Index products.

Instead, the protocol uses a primary market:

Mint (buy)

- You deposit one of the allowed underlying tokens (single-asset in).

- The protocol calculates the current value of the index basket.

- New index tokens are minted for you at that value (minus buy fee).

Burn (sell)

- You send your index tokens back to the protocol.

- The protocol burns those tokens.

- You receive one of the underlying tokens back (single-asset out), minus sell fee.

The total supply of the index token is therefore fully dynamic: it increases when users mint and decreases when users burn.

Once minted, the index token itself is a standard, freely transferable token. It can be traded on secondary markets (DEXs, aggregators, etc.). Arbitrage between the primary market and secondary markets helps keep the price close to the value of the underlying basket.

Fees

Each index has three fee types:

- Buy fee (mint fee) - one-time fee when you enter

- Sell fee (burn fee) - one-time fee when you exit

- Annual fee (TER, a management fee) - ongoing yearly fee on assets inside the index

You only ever see:

- a fee when you buy

- a fee when you sell

- and the effect of the annual fee over time in the token’s value

Buy fee

- Applied when you mint index tokens.

- Taken as a percentage of what you put in.

- Mutable: it can be updated over time for each index.

Changing the buy fee only affects future buyers, not existing holders.

Sell fee

- Applied when you burn index tokens to exit.

- Taken as a percentage of what you receive back.

- Immutable: fixed at index creation and cannot be changed later.

This means the cost to exit is known and cannot be increased on you in the future.

Annual fee

- A yearly percentage (TER) charged on the value held in the index.

- Immutable: chosen at index creation and locked forever for that product.

Because the annual fee and sell fee are immutable, long-term investors have a clear, predictable cost structure and do not risk unexpected fee hikes once an index becomes popular.

Strategic Indexes vs Liquid Indexes

Strategic Indexes

Strategic Indexes are the main "investment" products:

- follow a defined investment strategy (factor, thematic, smart beta, etc.)

- hold and rebalance a basket of assets to stay close to that strategy

- charge an annual fee (TER) for managing the index

For a normal user, this is the index you buy when you want diversified exposure to a specific theme or strategy with one token.

Liquid Indexes

Liquid Indexes are simpler building blocks:

- use transparent allocation rules (for example equal-weight baskets)

- typically have very low or zero annual fee

- are used internally as liquidity sources when Strategic Indexes rebalance

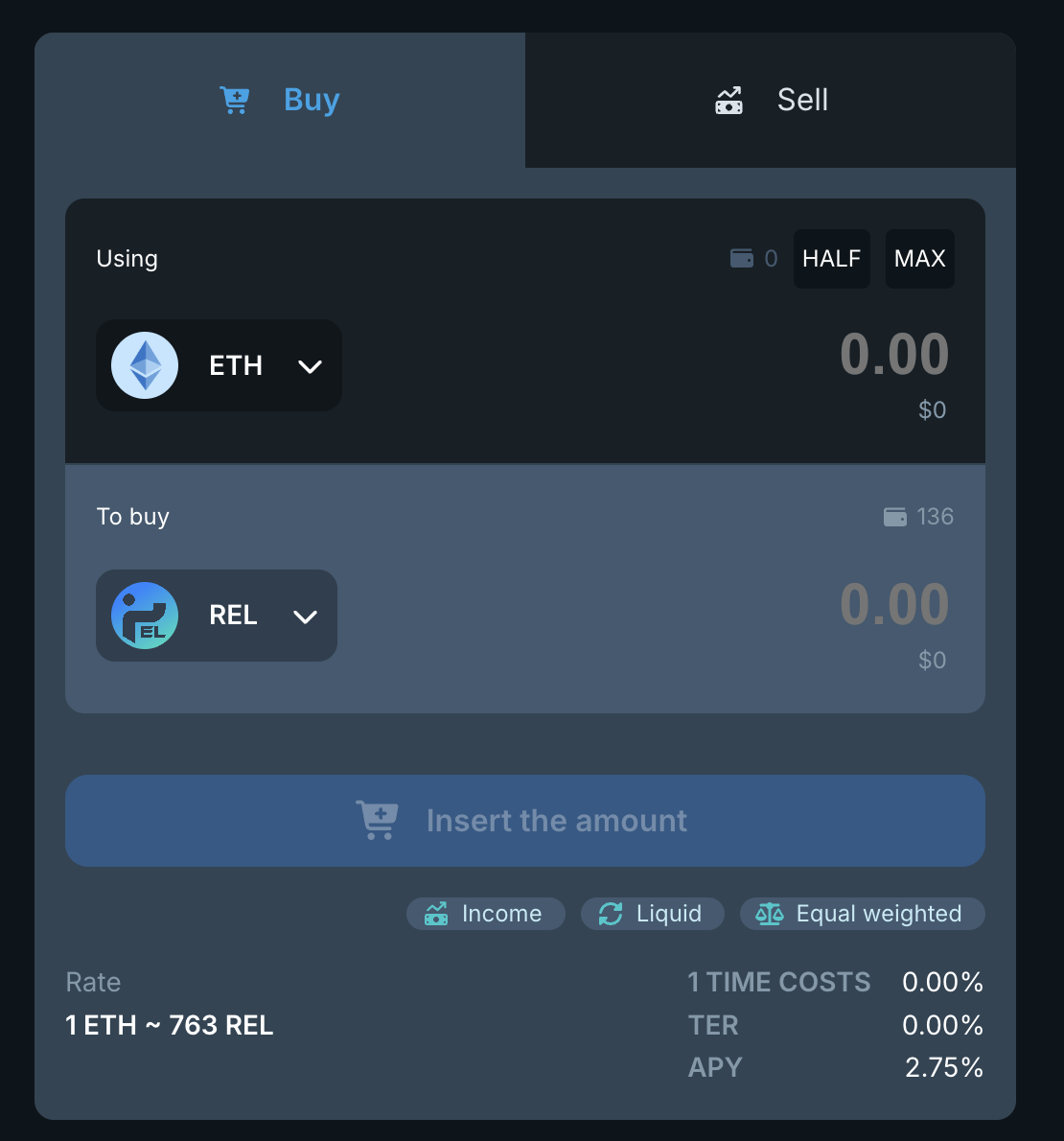

In the image below, you can see our liquid index available in our demo: you can notice that the liquid index has a specific tag applied and it has an associated APY.

How Liquid Indexes earn income

Strategic Indexes pay their annual management fee into the protocol.

Part of these fees is shared with Liquid Indexes that provide the underlying liquidity used during rebalancing.

For each asset, the protocol defines three immutable parameters:

- a liquidity goal for Liquid Indexes, expressed as a percentage of the combined NAV of the Strategic Indexes that use that asset

- a minimum share of fees that Liquid Indexes will always receive for that asset

- a maximum share of fees that Liquid Indexes can receive for that asset

At a high level:

- When the liquidity in Liquid Indexes for a given asset is low compared to the goal, that liquidity is very valuable for the protocol. In this situation, Liquid Indexes receive a share of the fees that is close to the maximum.

- As liquidity in Liquid Indexes grows and approaches the goal percentage of Strategic Index NAV, the share of fees paid to Liquid Indexes gradually decreases.

- Once liquidity is around or above the goal, the share converges to the minimum share. This minimum share is immutable and cannot be reduced after deployment.

This design has two important effects:

- When there is not enough liquidity in Liquid Indexes, the protocol strongly incentivizes it with higher fee sharing, helping bootstrap the system.

- When there is already plenty of liquidity, rewards do not explode and do not overpay for capital, but Liquid Indexes still get a guaranteed minimum fraction of the fees for that asset.

So:

- Strategic Indexes pay management fees.

- Liquid Indexes receive a share of those fees that depends on how much liquidity they provide relative to a goal that is a percentage of Strategic Index NAV.

- Holders of Liquid Index tokens can earn income from these shared fees, in addition to any price movement of the underlying basket.

Summary

- Reactive Index sells index tokens that represent baskets of on-chain assets.

- There are no liquidity pools behind them: instead there is a primary market that mints and burns tokens against the underlying assets.

- Each index has:

- a buy fee (mutable)

- a sell fee (immutable)

- an annual fee (immutable)

- Strategic Indexes implement investment strategies and charge TER.

- Liquid Indexes act as low-fee or zero-fee liquidity layers and receive a share of the fees generated by Strategic Indexes, with rewards that adapt based on how much liquidity they provide relative to protocol goals.